The logic behind the debt generated by educational and training institutions: the entire process from pre enrollment fees to the collapse and escape!

Time:2026-01-12

Source:Artstep

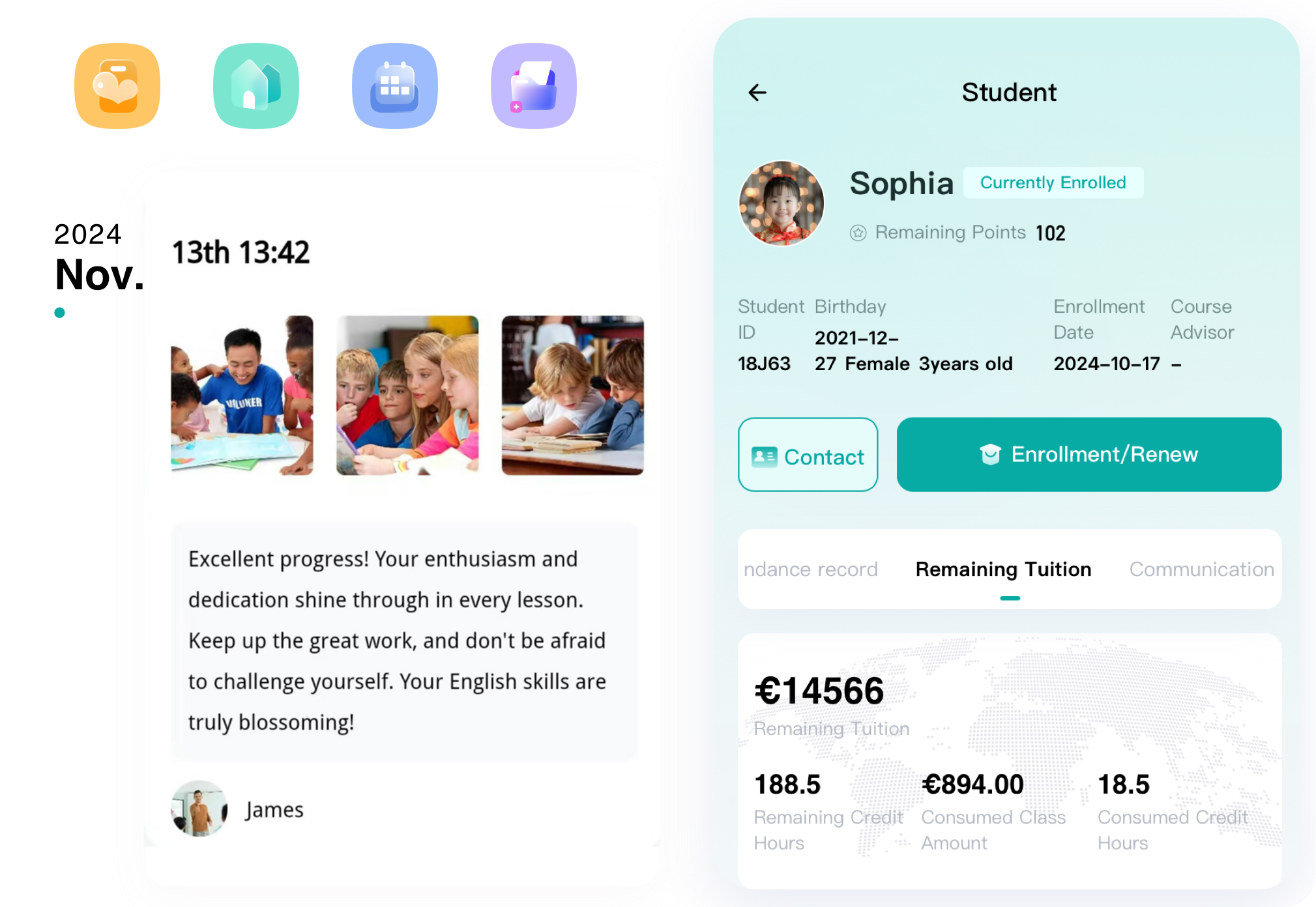

The institutional account clearly shows a flow of student tuition fees, but the funds seem to have been exchanged.

In the end, he was entangled in a heavy burden of debt, and both his life and business became passive.

The vast majority of education and training entrepreneurs have similar experiences, and at one point, they couldn't figure out the reasons behind them.

Their confusion is the same, that is, even though the money has passed their hands, they still owe countless debts.

The answer to this question is hidden in the deep logic of debt formation, and will be explored from three dimensions.

1. Firstly, this confusion is not an isolated case.

In the years of fluctuations in the education and training industry, similar situations are not uncommon.

Many entrepreneurs have experienced or are still experiencing the gap from the joy of calculating enrollment performance to being crushed by debt.

The day before, I was still excited about the performance of the newly added students and planning the development blueprint of the institution.

The next day, due to cash flow issues, one may be overwhelmed by a series of debts.

In fact, the thunder of debt never explodes suddenly.

Just like inflating a balloon, you think you are accumulating performance, but in reality, you are blowing a bubble that can burst at any time, and risks have already grown in the inflation.

Speaking of which, the seed of debt in this industry is often quietly planted in the early stages of entrepreneurship.

Core Root:

Entrepreneurs have fundamentally misjudged the nature of money.

The most direct manifestation of this misjudgment is treating the prepaid tuition fees of students as one's own profit.

This is like opening a baozi shop, using the prepaid baozi ticket money from customers directly to pay rent and open a branch.

When the customer came to pick up the buns, they realized that they had already run out of money to stock up.

The prepayment in the education and training industry is essentially a service commitment to be fulfilled, but it is treated as disposable cash flow.

Confidently believing that as long as enrollment is sustainable, performance can always match costs.

The enrollment flow has increased, and even if the cost is a little higher, it is not afraid. Over time, ignoring the fixed risks brought by cost growth has led to a larger funding gap, but it continues to divert unused course funds to fill it.

This seemingly normal blind expansion brings about cost control, which further exacerbates the debt problem.

Driven by the industry boom, many entrepreneurs are prone to the misconception of short-term profits.

They equate short-term profits with long-term trends and follow the trend when they see peers opening branch schools.

Increased expenditure:

Fixed costs such as rent and teaching staff continue to accumulate, but core indicators such as full class occupancy rate, personnel efficiency, cost, and unused classes are ignored.

When the industry cools down and enrollment declines, the income side suddenly tightens, and expenses such as rent and salaries are not insignificant, the demand for refunds and delivery costs erupt again;

We can only rely on credit cards, online loans, and other methods to make up for the situation, and the debt snowball starts rolling.

Behind these apparent debt difficulties is a set of interconnected debt formation logic.

Every mistake at every stage is pushing entrepreneurs towards the abyss of debt.

From initial cognitive bias towards the nature of funds to decision-making errors in the business process; From inadequate response to risks, the problem progresses layer by layer and is interrelated.

This is not simply a matter of luck, but the result of multiple factors working together.

Only by clarifying these logical links can we fundamentally understand the causes of debt.

2. The first core logical misconception is the mismatch of prepaid fees with self owned funds.

The pre paid model was originally a routine means for the industry to lock in students, but it has become a touchstone for testing entrepreneurs' cognition.

Many entrepreneurs feel itchy when they see pre paid deposits, either using them for expansion investment or filling in daily expenses.

Treat the funds originally intended for subsequent teaching services as immediately available profits.

This operation essentially involves filling the current funding pit with future service bonds. Once the inflow of new prepaid fees is interrupted, the old service commitments and refund demands will form a debt gap.

More seriously, the financial boundaries are blurred, and institutional accounts are mixed with personal accounts, ultimately completely blurring the boundary between liabilities and income.

3. The second logical hazard is the cost black hole generated by the scale myth.

The cost structure of the education and training industry has its particularity, with fixed costs such as rent and wages accounting for a very high proportion.

Blind expansion will directly lead to rigid cost increases, while income depends on the uncertainty of enrollment and full class rates.

Many entrepreneurs mistakenly equate the number of campuses with a symbol of strength and hastily layout when the profitability of a single campus is not yet stable.

Even if the enrollment of the new campus falls short of expectations, monthly expenses such as rent and basic salary still need to be rigidly paid.

When the profits of the old campus are swallowed up by the costs of the new campus, pre fees become a choice to fill the gap, further exacerbating debt risks.

4. The third risk trigger point: cash flow fragility under external shocks.

The cash flow of the education and training industry naturally relies on the closed-loop cycle of "enrollment fee consumption", which is inherently fragile.

Once encountering external variables such as policy adjustments or sudden public events, the closed loop may break instantly.

Changes at the policy level can directly lead to a sharp decline in core revenue, while sudden public events can cause offline teaching to come to a halt, resulting in almost zero revenue.

More importantly, most entrepreneurs lack awareness of risk reserves, neither reserving emergency funds nor building diversified business backups.

Faced with shocks, we can only passively rely on borrowing to fill the gap, leading to a concentrated outbreak of debt.

Improper response in the early stages of debt can lead to a spiral amplification of risk in a logical loop.

Once this closed loop is formed, the scale of debt will rapidly expand and become difficult to control.

Lucky mentality:

Faced with an initial funding gap, many entrepreneurs have a lucky mentality of just holding on and passing.

They choose convenient but high cost financing methods such as online loans and consumer loans, ignoring the cumulative effect of interest compounding.

Transfer risk:

Some even transfer risks internally and guide employees to borrow in their personal names for institutional turnover.

This operation not only triggers a crisis of trust, but also complicates debt relationships, extending from business debt to personal credit risk.

Ultimately, the debt of education and entrepreneurship entrepreneurs is never a sudden disaster.

It is the result of multiple factors working together and has a clear formation trajectory.

Cognitive bias:

Treating prepaid fees as profits is a misunderstanding of the nature of funds; Blind expansion without cost control is a disregard for business laws; Borrowing indiscriminately when encountering a gap is an escape from risk.

These problems overlap and accumulate, eventually becoming the last straw that breaks the camel's back.

The essence of debt is the mismatch between the flow of funds and the commitment of responsibility.

Funds are not used to fulfill service commitments, but are instead arbitrarily disposed of, resulting in debt.

The core of training entrepreneurs to avoid debt traps is to clarify the logic of funding.

Prepayments are clients' custodial funds rather than profits, and expansion requires a rational layout that matches returns rather than face saving projects.

Risk management relies on reserves rather than borrowing.

Understanding the nature of money and calculating the boundaries of costs are the bottom line for survival in education, training, and entrepreneurship, as well as the key to avoiding debt crises.